The cost is not just financial. It is psychological.

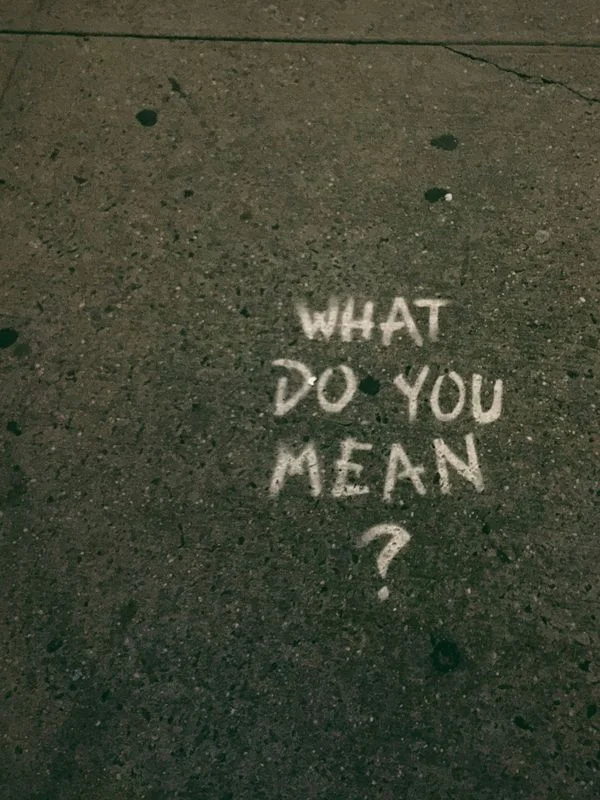

Many expats who leave Europe after two or three years cite the same frustration: "I never felt like I understood how things worked. Every January, something changed, and no one explained why."

The system was not designed to exclude them. It was designed for people who already understand it — through education, family, or cultural immersion. Expats arrive without that foundation. The January unease is the moment where that gap becomes tangible.

Those who learn to treat the unease as diagnostic information regain control. They stop waiting for the system to explain itself. They verify assumptions, document discrepancies, and intervene early. Over time, January stops feeling like a trap and starts feeling like a routine checkpoint.

Those who ignore the signal often experience the opposite arc. Year after year, the unease returns. The explanations come late. The corrections get harder. Eventually, they conclude that Europe is simply opaque, bureaucratic, and hostile to outsiders.

The system is the same in both cases. The difference is how expats respond to the whisper. Understanding this dynamic is explored in Why Expats Leave Europe After 2-3 Years (And Why Others Stay).